Electric vehicle adoption continues to accelerate worldwide, placing pressure on battery technology to become cheaper, safer, and more sustainable.

Automakers and battery manufacturers are facing rising material costs, tighter environmental scrutiny, and growing consumer expectations for reliability and range.

Predictions for 2026 point toward a noticeable shift in battery development priorities.

Sodium-ion initiatives are gaining momentum alongside continued lithium-ion refinement, signaling a potential change in how future EVs store energy.

Can sodium-ion batteries realistically challenge lithium-ion dominance in electric vehicles, or will lithium remain the primary solution for years ahead?

Why Lithium-Ion Has Ruled the EV Era

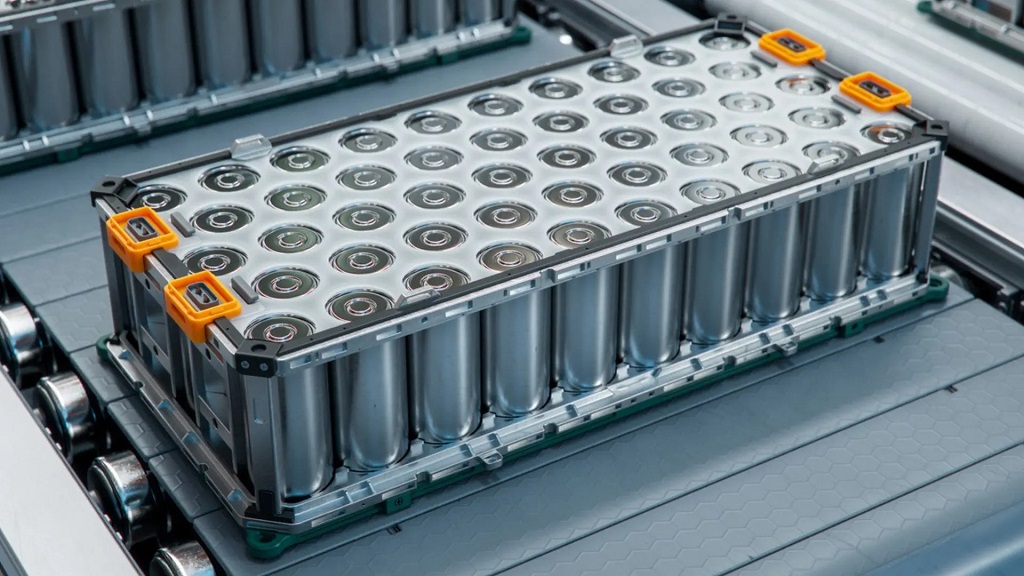

Electric vehicle progress moved in step with lithium-ion battery maturity, linking modern EV success directly to lithium-based storage. Automakers gravitated toward a solution already proven across smartphones, laptops, grid storage systems, and early electric vehicles.

Sustained investment shaped that dominance. Research spanning decades refined cell chemistry, improved cycle life, stabilized charging behavior, and reduced failure rates.

Automotive qualification standards demanded durability across years of vibration, temperature swings, and repeated fast charging, all areas where lithium-ion gradually proved reliable at scale.

Energy density remains a defining advantage, especially for vehicles designed around extended driving range.

Higher density enables lighter battery packs, longer range, and greater flexibility in vehicle architecture. Platforms targeting highway travel and premium performance gain direct benefits as weight drops and usable cabin space increases.

Manufacturing strength further reinforces lithium-ion leadership. Cell factories operate across Asia, Europe, and North America using standardized formats that simplify integration and sourcing.

Supplier ecosystems support electrodes, electrolytes, separators, and power electronics at a massive scale. Recycling capacity continues expanding, reducing long-term material risk even though recovery efficiency still varies.

The Growing Problems with Lithium

Scaling electric vehicles has exposed stress points tied to lithium-ion reliance. Supply security, environmental impact, and safety risks now influence regulation, investment decisions, and vehicle pricing.

Material availability creates uncertainty. Lithium remains relatively scarce and geographically concentrated, exposing supply chains to mining constraints and geopolitical pressure. Price volatility complicates long-term cost planning for manufacturers attempting to deliver affordable electric models.

Environmental impact adds further strain. Extraction and refining linked to lithium and cobalt require significant water and energy input, often affecting surrounding ecosystems.

Battery end-of-life introduces additional complexity as mixed chemistries challenge recycling efficiency.

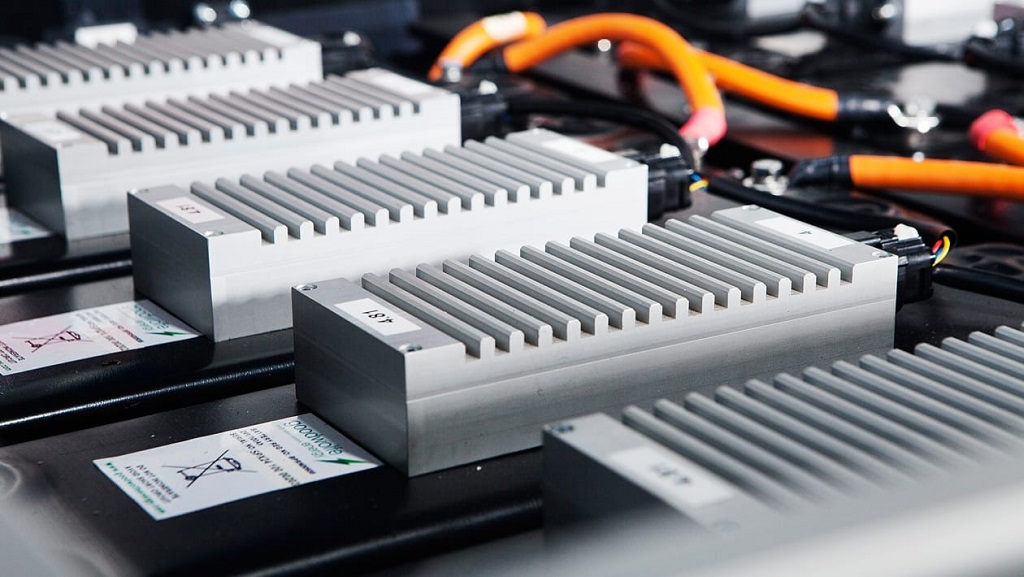

Safety engineering remains a constant focus. Thermal runaway risk forces layered protection at cell, module, and pack level, increasing weight, cost, and design complexity.

Several recurring issues define these limitations:

- Sensitivity to overheating and mechanical damage

- Dependence on advanced battery management systems

- Increased safety engineering at the pack level

Enter Sodium-Ion Batteries

Sodium-ion batteries operate using the same electrochemical principles as lithium-ion systems. Ions shuttle between the cathode and anode during charging and discharging, storing energy through reversible reactions.

Material substitution creates a meaningful shift. Sodium replaces lithium as the charge carrier, reducing reliance on scarce resources while preserving familiar cell structures.

Manufacturing expertise developed for lithium-ion can transition more easily compared with entirely new storage concepts.

Abundance defines a key advantage. Sodium ranks as the sixth most common element on Earth, supporting a stable supply and lower exposure to material bottlenecks tied to mining capacity.

Commercial progress accelerated rapidly during recent years. Sodium-ion cells moved beyond laboratory validation and entered early production, supported by major manufacturers.

Concrete indicators signal that shift:

- Early commercial deployments are already underway

- Large-scale production targets announced around 2026 by companies such as CATL and Stellantis

Performance characteristics attract attention across targeted EV segments. Improved thermal safety lowers fire risk, while strong cold-weather behavior suits urban vehicles and colder regions.

Lower raw material costs position sodium-ion as a practical option where an extreme range remains less critical.

Sodium-Ion vs. Lithium-Ion

Comparing sodium-ion and lithium-ion batteries requires looking past a single performance metric. Vehicle range, cost stability, safety behavior, climate resilience, and environmental footprint all shape how each chemistry fits into future electric vehicle segments.

Tradeoffs between maturity and material availability define how manufacturers evaluate both options.

Distinct strengths and limitations emerge once each factor is examined in detail, revealing why neither chemistry serves as a universal solution across all EV categories.

Energy Density

Energy density remains the most visible separation point between the two chemistries. Vehicle range, pack weight, and interior packaging depend heavily on how much energy a battery stores per unit mass.

Measured performance data clarifies the difference:

- Lithium-ion cells commonly achieve 240 to 350 Wh per kilogram

- Sodium-ion cells currently reach about 100 to 175 Wh per kilogram

Lower density requires heavier battery packs to reach similar driving ranges. Long-distance vehicles, performance models, and premium EVs remain better suited to lithium-ion due to stricter weight and range targets.

Cost and Raw Materials

Material availability plays a central role in long-term battery economics. Sodium offers a much broader supply base than lithium, reducing exposure to price volatility and regional concentration.

Geological distribution illustrates that contrast clearly:

- Sodium represents roughly 2.6% of Earth’s crust

- Lithium accounts for about 0.002%

Production at scale could allow sodium-ion batteries to reach a lower cost per kilowatt-hour as supply chains mature and manufacturing volumes increase. Entry-level EVs and fleet vehicles benefit most directly from that cost potential.

Safety and Thermal Stability

Thermal behavior differs significantly between the two chemistries. Sodium-ion batteries exhibit lower chemical reactivity, which reduces the likelihood of overheating and combustion.

Improved stability can simplify system design. Less aggressive cooling requirements and reduced reliance on layered protection may lower pack complexity and manufacturing cost in suitable applications.

Performance in Temperature Extremes

Cold-weather performance represents a meaningful advantage for sodium-ion technology. Capacity retention remains stronger at low temperatures compared with many lithium-ion cells, which often experience reduced output and slower charging in cold conditions.

Urban vehicles, delivery fleets, and entry-level EVs operating in colder regions gain reliability benefits as winter performance becomes more predictable.

Cycle Life and Charging

Durability varies widely across both chemistries, depending on electrode materials and electrolyte formulations. Recent sodium-ion designs already demonstrate cycle life comparable to select lithium-ion configurations, supporting long service intervals.

Charging behavior also shows competitive potential. Properly designed sodium-ion cells can support fast charging rates without rapid degradation, aligning well with daily-use vehicle patterns.

Environmental Impact

Material sourcing shapes environmental outcomes across the full battery lifecycle. Sodium-ion batteries rely on elements that are easier to extract and less environmentally intensive than lithium and cobalt.

Simpler material profiles also support more straightforward recycling pathways, improving sustainability prospects as large-scale adoption increases and battery end-of-life volumes grow.

Is the Next Generation of EV Batteries Finally Here?

Commercial readiness continues improving for sodium-ion technology. Early deployment and announced large-scale production plans around 2026 indicate a shift toward practical adoption.

Lithium-ion remains essential for high-performance and long-range electric vehicles. Superior energy density and deeply established infrastructure preserve its central role in premium EV segments.

Future battery development points toward coexistence rather than replacement. Multiple chemistries will likely serve different vehicle categories, cost targets, and performance requirements, shaping an EV market defined by specialization rather than a single dominant solution.